Our history

The history of CRIF at a glance:

-

1988 CRIF is founded in Bologna, Italy.

-

1997 CRIF Decision Solutions Ltd. is established in the UK to provide financial analysis, reporting and monitoring services and fraud prevention solutions to UK insurance companies.

-

1999 CRIF Decision Solutions Ltd. expands in the UK through the acquisition of Qui Credit Assessment Ltd. CRIF NORTH AMERICA Corp. is established in Tampa (Florida, USA). With Tampa (Florida, USA) based CRIBIS Corp., CRIF develops and distributes online decision support systems on an international level for strategic management of credit and marketing activities and access to information on companies, sectors and markets in 230 countries.

-

2001 The strategic alliance with the American company TRANSUNION, leader in the NAFTA market, creates two companies focusing on customised and model-based solutions in Mexico (TRANS UNION CRIF DECISION SOLUTIONS S.A. de C.V.), Central and South America and Canada (TRANSUNION CRIF DECISION SOLUTIONS LLC).

-

2005 CRIF acquires 100% of the shares of CCB - CZECH CREDIT BUREAU and later of SCB - SLOVAK CREDIT BUREAU, two companies managing the credit bureaus of the Czech and Slovak Republics respectively. CRIF's expansion also extends to the Russian market, where the company establishes the National Bureau of Credit Histories (NBCH) together with the National Banking Association (ARB) and some of the most important banks in Russia.

-

2006 CRIF acquires INFIN, a company providing business information services, analysis and consulting services to companies and public institutions in the Slovak Republic.

-

2007 InfoData (founded in 1990 as a department of the Polish Chamber of Commerce) becomes part of the CRIF Group. CRIF Sp. Z.o.o is acquired. The company provides value-added information services in Poland, delivering high-quality data and up-to-date researched credit reports on all Polish and foreign companies, as well as analytics, consulting, outsourcing and software solutions. OOO CRIF is established in Russia to provide a range of services, including consulting, analytics, outsourcing, software and debt collection solutions.

-

2008 INFIN merges with SCB - the Slovak credit bureau.

-

CRIF strengthens its presence in the Americas with CRIF Corp. (headquartered in Tampa, USA), Magnum (headquartered in Atlanta, USA) and CRIF S.A. de C.V. (headquartered in Mexico City), which provide decision support and software solutions to financial institutions, service providers and enterprises.

-

In July 2008, CRIF acquires Teres Solutions, a company based in Texas (USA). Teres Solutions develops advanced solutions for direct and indirect credit, representing the reference standard in the financial services market.

-

2009 CRIF strengthens its presence in the business information market with the acquisition of Dun & Bradstreet (D&B) Italy. The creation of CRIBIS D&B provides clients and the market with increasingly detailed information as well as the competence and experience of D&B, one of the most important providers of economic information in the world.

-

CRIF and HUAXIA International Credit Group establish a new joint venture called HuaxiaCRIF China to provide credit risk advisory and information services to the Chinese market.

-

CRIF continues its expansion in the US with the acquisition of FLS Services (headquartered in Dallas, Texas), Aimbridge Indirect Lending LLC and Member Lending Acceptance LLC (headquartered in Denver, Colorado). The focus of these two companies is on indirect and direct lending solutions. CRIF Zrt, the newly established CRIF Group company based in Budapest, Hungary, obtains a licence from PSZAF, the Hungarian Financial Supervisory Authority, to establish the first fully private credit bureau on a voluntary basis in Hungary, providing both positive and negative credit information on individuals and companies.

-

2010 CRIF acquires APPRO Systems from Equifax. APPRO Systems is a market-leading provider of credit origination and account opening solutions for financial institutions in the US.

-

During 2010, CRIF enters into a partnership with High Mark Credit in India, and in Vietnam, CRIF is selected by PCB as a partner to build the first world-class credit bureau in the country. According to the strategic partnership agreement signed in Vietnam, CRIF is now PCB's largest shareholder.

-

2011 CRIF acquires Cypress Software Systems in the USA. Cypress is a provider of a range of software solutions and services that help financial institutions automate their loan application, risk assessment and decision-making processes. CRIF establishes CRIF Beijing in China to provide credit risk management solutions to Chinese retail banks, consumers and vehicle finance companies. CRIF acquires Deltavista Switzerland and Deltavista Austria. The Deltavista Group, headquartered in Zurich (Switzerland), is one of the leading credit bureaus and providers of risk management information in the German-speaking region.

-

2012 In 2012, CRIF NM, a joint venture between CRIF and Neal & Massy, obtained a licence to establish a world-class credit bureau, bringing additional value to Jamaica and the Caribbean. CRIF opened a new office in Jakarta, Indonesia, as part of its expansion strategy in Asia Pacific to support local banks, financial institutions and insurance companies with its proven expertise in credit and business information and decision management systems. Acquisition of Dun & Bradstreet Turkey, Finar and Kompass Turkey.

-

2013 CRIF strengthens its presence in Asia Pacific with new offices in Hong Kong and the Philippines.

-

2014 CRIF expands its operations in Turkey with the acquisition of a majority stake in Recom, a leading player in the debt collection sector. CRIF acquires OFWI - Teledata from Axon Active Holding AG to strengthen its leadership position in the Swiss credit industry. CRIF acquires a majority stake in High Mark Credit Information Services, a leading provider of credit information to the microfinance, trade, MSME and corporate sectors in India. CRIF acquires Dun & Bradstreet UAE in Dubai, the leading provider of data and business information in the United Arab Emirates.

-

2015 CRIF becomes Nomisma's largest shareholder. Nomisma is an independent Italian economic research company that advises companies, associations and public administrations at national and international level.

-

2016 CRIF acquires Bürgel in Germany, a joint venture between leading credit insurer Euler Hermes and international financial services provider EOS. CRIF further expanded its operations in Germany and Poland through the acquisition of Deltavista, the leading provider of credit rating data and risk management services. CRIF acquired Microfinance Technologies Center (MTC) in Russia, a growing industry player in the microfinance sector for the provision of credit risk analysis services. CRIF acquired CCIS-China Credit Information Service, Taiwan's largest and leading credit bureau.

-

2017 CRIF strengthens its position in Jamaica by acquiring all shares in CRIF NM Credit Assure Ltd.

-

July 2017: The internationally active credit agency group CRIF announces the merger of its German subsidiaries, Bürgel Wirtschaftsinformationen and CRIF GmbH. The new unified company will continue business operations under the CRIFBÜRGEL brand, registered under commercial law as CRIF Bürgel GmbH.

-

In Russia, CRIF acquires in 2017 the activities of Luxbase LLC, a company offering software for the automation of collection processes to banks, microfinance organisations and utilities.

-

CRIF continues its expansion in the Far East with the acquisition of 100% of PT VISI in Indonesia, a company specialising in business information services, and through two start-up companies in Singapore and Malaysia that offer consulting services, software and innovative solutions for credit management.

-

In 2018, CRIF acquired Vision-Net, a leading business information provider in Ireland, to strengthen its local presence in business information and decision support solutions.

-

In Southeast Asia, CRIF acquired Dun & Bradstreet Vietnam and its franchise operations in Brunei, Laos, Myanmar and Cambodia to help companies develop their businesses. In addition, CRIF strengthened its leading position in business and credit information and risk management solutions in the ASEAN region with the acquisition of Dun & Bradstreet Philippines.

-

CRIF is the first Open Banking AISP to be registered in more than 20 European countries. Thanks to the acquisition of Credit Data Research Realtime Holdings Ltd. by its wholly owned subsidiary CRIF Bürgel, CRIF is now able to offer Open Banking services that enable the exchange of retail credit payment data between consumers/businesses and organisations and improve transparency in dealing with business partners and customers.

-

2019 CRIF acquires majority stake in Inventia - the digital identification software company. With Inventia's technology, CRIF has strengthened its "Omnichannel Smart Onboarding" platform for credit processes and added components that improve the user experience when interacting with the end customer. CRIF acquires BizInsights, a leading global business intelligence provider in Singapore. CRIF BizInsights will be able to provide Singaporean and global companies and professionals with business information and detailed analytics to improve credit risk management, simplify competitor and supplier monitoring, enhance customer centricity and meet due diligence and compliance requirements. CRIF is the first Open Banking AISP to be registered in more than 20 European countries. Thanks to the acquisition of Credit Data Research Realtime Holdings Ltd. by its wholly owned subsidiary CRIF Buergel, CRIF is now able to offer Open Banking services that enable the exchange of retail credit payment data between consumers/businesses and organisations and improve transparency in dealing with business partners and customers. CRIF completes its coverage as an AISP by registering CRIF RealTime Ireland. The authorisation granted to CRIF RealTime Ireland extends CRIF's scope of activity as an AISP to all 31 countries where the revised Payment Services Directive applies

-

2020 CRIF acquires the entire shares of Strands, a FinTech company specialising in advanced digital banking solutions. Strands is one of the world's leading providers of AI-driven business and personal financial management with offices in the US, Spain, Asia and South America.

The history of BÜRGEL at a glance

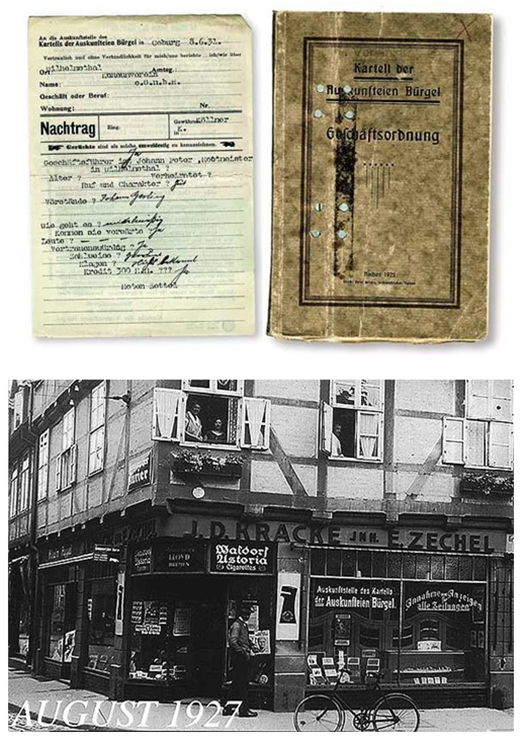

Social changes, new modes of production, urbanisation and rural exodus characterised the period at the turn of the 20th century. After years of severe crisis, Germany was on its way to becoming a leading industrial nation. Already during this time, Martin Bürgel GmbH provided the German economy with up-to-date information to protect against bad debts.

When in 1903 the company, which had been founded in 1885 in Aachen as an association of Bürgel merchants, was transformed into the "Cartell der Vereinigten Auskunfteien Bürgel" and Bürgel Centrale GmbH was founded, this was already done in the spirit and sense of a franchise organisation. As early as 1908, 300 offices in Germany and other European countries operated under the name Centrale des Kartells der Auskunfteien Bürgel GmbH. Bürgel then became a "real" franchise company in 1994 when the partnership agreements were concluded.

Twice in the course of the century, Bürgel had to rebuild almost the entire archive, the equipment, many offices and also the worldwide contacts - due to the events of the war. With the IT age, e-mail and computerisation, a new era of data processing began for Bürgel. In addition, the coming into force of the Federal Data Protection Act in 1978 changed the information landscape in Germany. In 1990, Bürgel Wirtschaftsinformationen GmbH & Co. KG was founded in Hamburg as a joint venture between Hermes Kreditversicherung and Bürgel, and one of the most modern databases in Europe was established. When the Bürgel database went online in 1993, the paper archives of all Bürgel offices, which had grown over decades, had been entered into it by machine and, above all, by hand. Tonnes of written data were converted into 6.6 million stored data objects. Today, the Bürgel database is the heart of all Bürgel services and products. Technical innovations such as the Fraud Prevention Pool, the Internet platform Net Connect or Bürgel's multifunctional interface Remote Connection Services revolutionised credit management in Germany.

In 1998, Deutscher Inkasso-Dienst, today EOS Holding GmbH (Otto Group), became Bürgel's second shareholder alongside Euler Hermes Deutschland AG (Allianz Group).

Since its foundation, Bürgel has stood for quality and service with its diverse and innovative products and services in the field of business and creditworthiness information. Over the years, the business areas of receivables management, address management and address investigations were built up.

In June 2015, Bürgel celebrated its 130th anniversary.

The globally active credit agency group CRIF became a new shareholder of the Bürgel Group in 2016.