ESG BASIC INDICATOR

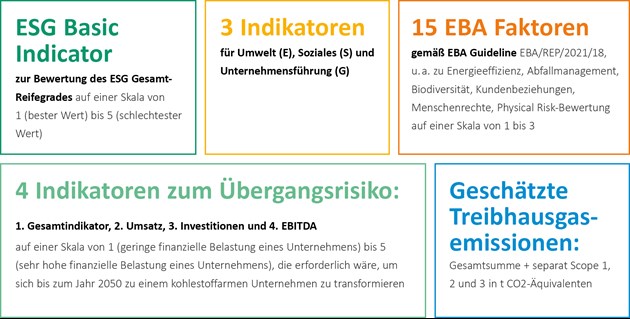

CRIF uses the ESG Basic Indicator to assess a company's sustainability efforts based on key environmental, social, and governance (ESG) criteria. The scale ranges from 1 (best rating) to 5 (worst rating).

The model is based on a representative sample of European companies and uses over 140 ESG data points from our company database. It draws on existing economic data such as revenue, number of employees, industry, and legal form to enable an objective ESG assessment. The variables were selected using a combination of statistical analysis and expert validation.

The ESG Basic Indicator covers the ESG requirements of the European Banking Authority (EBA) and assesses, among other things:

- Environment: energy efficiency, CO₂ emissions, waste management, biodiversity

- Social: working conditions, human rights, diversity

- Governance: transparency, ethical business conduct, risk management

In addition, transition risks are calculated separately to reflect the economic impact of a sustainable transformation by 2050. The indicator provides estimates of Scope 1, 2, and 3 emissions and enables an informed ESG assessment.

Advantages for banks and financial service providers

- Highly informative thanks to the use of real economic data

- Comparability of companies from different EU countries

- Easy implementation – only a few basic data required (company name, VAT or commercial register number, address)

- Regulatory compliance with EBA, BaFin, and EU taxonomy

- Detailed ESG data including transition risks, CO₂ emissions, and physical risks

- Efficient initial assessment of credit portfolios without customer surveys

- Companies can further refine their ESG assessment using the CRIF Synesgy questionnaire

Data provision

- Batch enrichment with optimized data format for banks

- Online integration via API in the Skyminder portal

- Human-readable report with visualized ESG data in real time

The ESG Basic Indicator enables reliable, standardized, and regulatory-compliant ESG assessment – efficient and easy to integrate into existing processes