The upgrade for greater transparency in credit risk management

As a CEO, CFO, or credit risk manager, you face a multitude of complex challenges today: the number of insolvencies is rising, payment behavior is deteriorating, supply chains are increasingly unstable, and geopolitical uncertainties and inflation are making planning difficult. At the same time, the demands of day-to-day business are growing: digitalization, compliance guidelines, and ESG requirements demand your full attention.

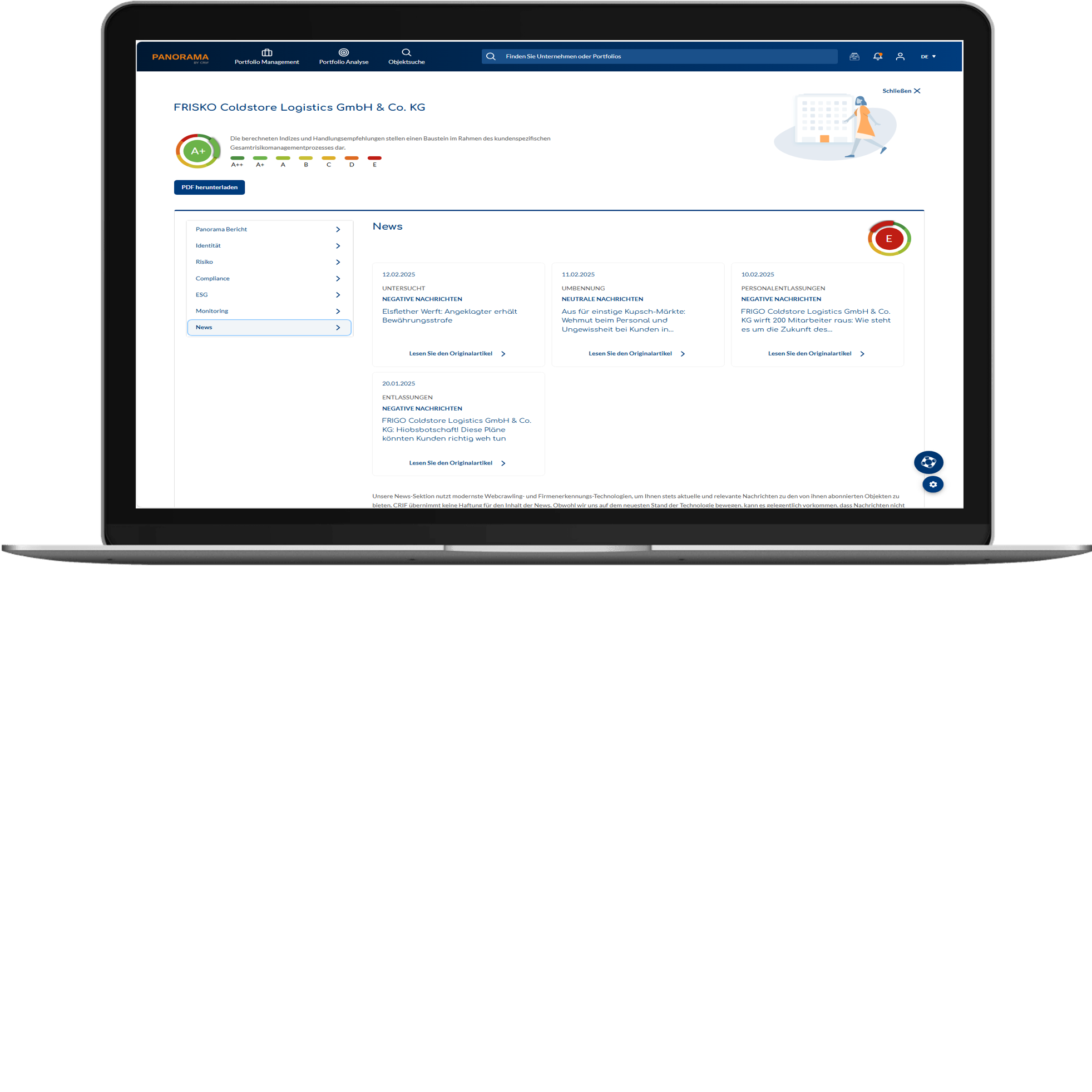

In discussions with our customers and partners, it became clear that the traditional provision of information via long PDF documents no longer meets these requirements. It's time for an upgrade.

Goodbye credit reports, hello Panorama!

With Panorama, you get all the relevant credit information and risk data on your business partners in a central, intuitive dashboard. If necessary, you can add in-depth analyses of identity, risk, compliance, and ESG—flexibly and at the click of a mouse.

This allows you to make informed decisions faster, minimize risks, and create space for what really matters: sustainable growth and operational excellence.