The deterioration of customer creditworthiness is often a gradual process. This can lead to dangerous misjudgments by decision-makers, which can ultimately result in bad debts and financial losses. Efficient monitoring is therefore essential to identify potential risks in good time.

Our solution DDMonitor

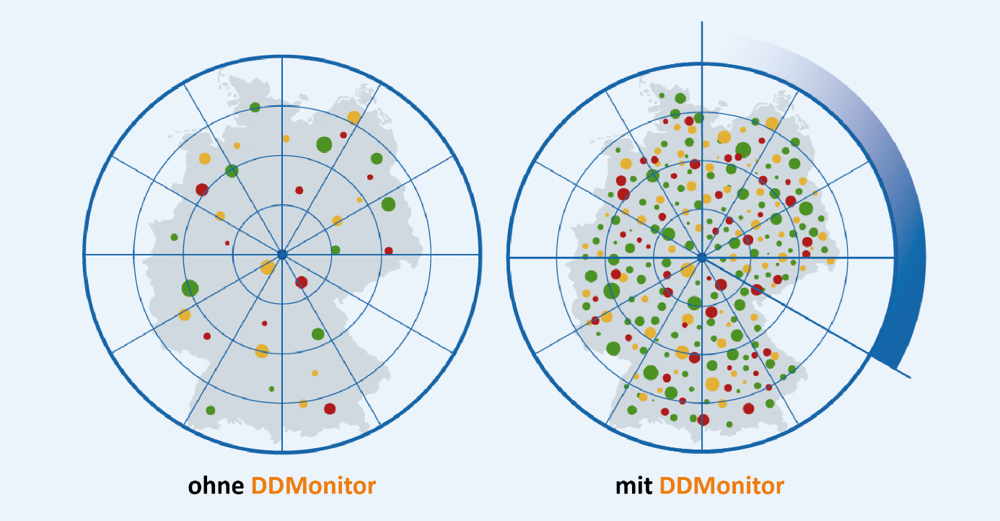

DDMonitor provides comprehensive, reliable, and up-to-date information about your entire customer portfolio. By processing millions of collection movements and payment experiences, DDMonitor enables targeted and automated monitoring of critical changes in your customers' payment behavior.