Your partner in Credit Management

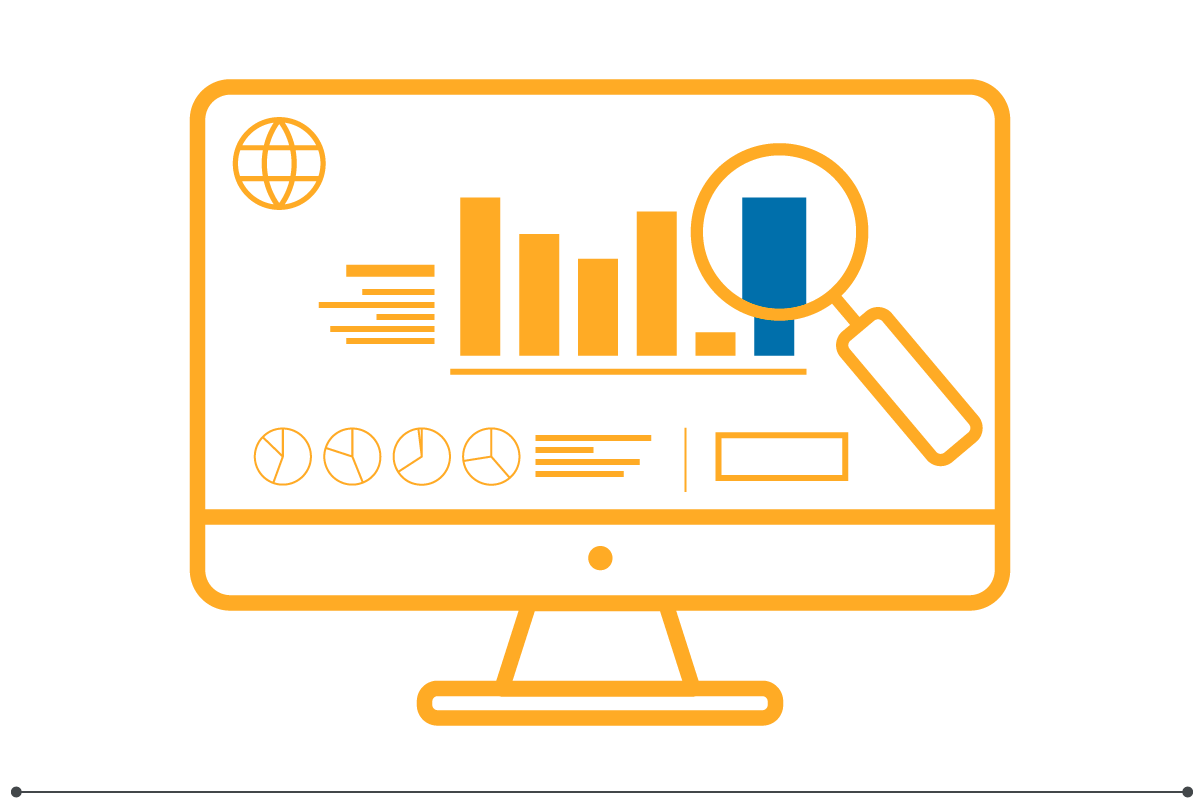

The risks and requirements in financial and compliance management are becoming increasingly complex. National and international business partners and suppliers must be continuously evaluated and monitored in order to avoid financial and reputational risks and comply with regulatory requirements. Manual processes and incomplete information can lead to costly misjudgments.

Our solution

CREDITY is the cloud solution for the efficient management of financial and compliance risks in your customer and supplier portfolio. You receive a comprehensive overview of the risks and opportunities of your national and international business partners and suppliers in real time. Through optimized monitoring and ongoing assessments, CREDITY supports you in managing financial risks and minimizing compliance risks.